Do you believe that knowledge is the most powerful investment you can make? Whether you are just getting started with your financial journey or are an experienced investor, you need to read certain books that serve as your blueprint for wealth management.

You might be investing in the stock market, or willing to grow your wealth long-term. In any case, a comprehensive understanding of the principles of investing can shape your financial mindset correctly.

In this blog, we have shared the top five books on finance every person should read. With this knowledge, you can empower yourself to make smarter financial decisions

Top Personal Finance Books You Must Read

Here are five must-read personal finance books that can transform your perspective on money management

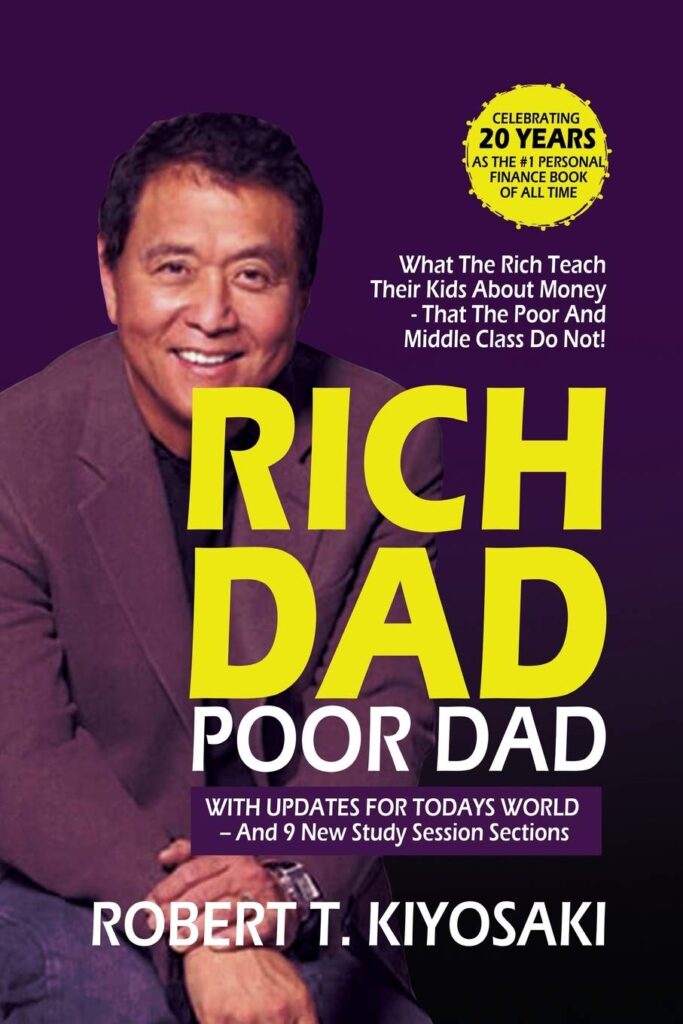

1. Rich Dad Poor Dad by Robert Kiyosaki

This classic bestseller explores the financial lessons Robert Kiyosaki learned from his two father figures: his educated but financially struggling biological father (“Poor Dad”) and his wealthy, entrepreneurial mentor (“Rich Dad”). The book challenges conventional ideas about money and work

Key Takeaways:

- Understand the difference between assets and liabilities

- Learn the importance of financial education

- Discover how to make your money work for you

Why It’s a Must Read:

“Rich Dad Poor Dad” is an eye-opener for anyone stuck in the rat race. It simplifies complex financial concepts and inspires readers to rethink their approach to wealth

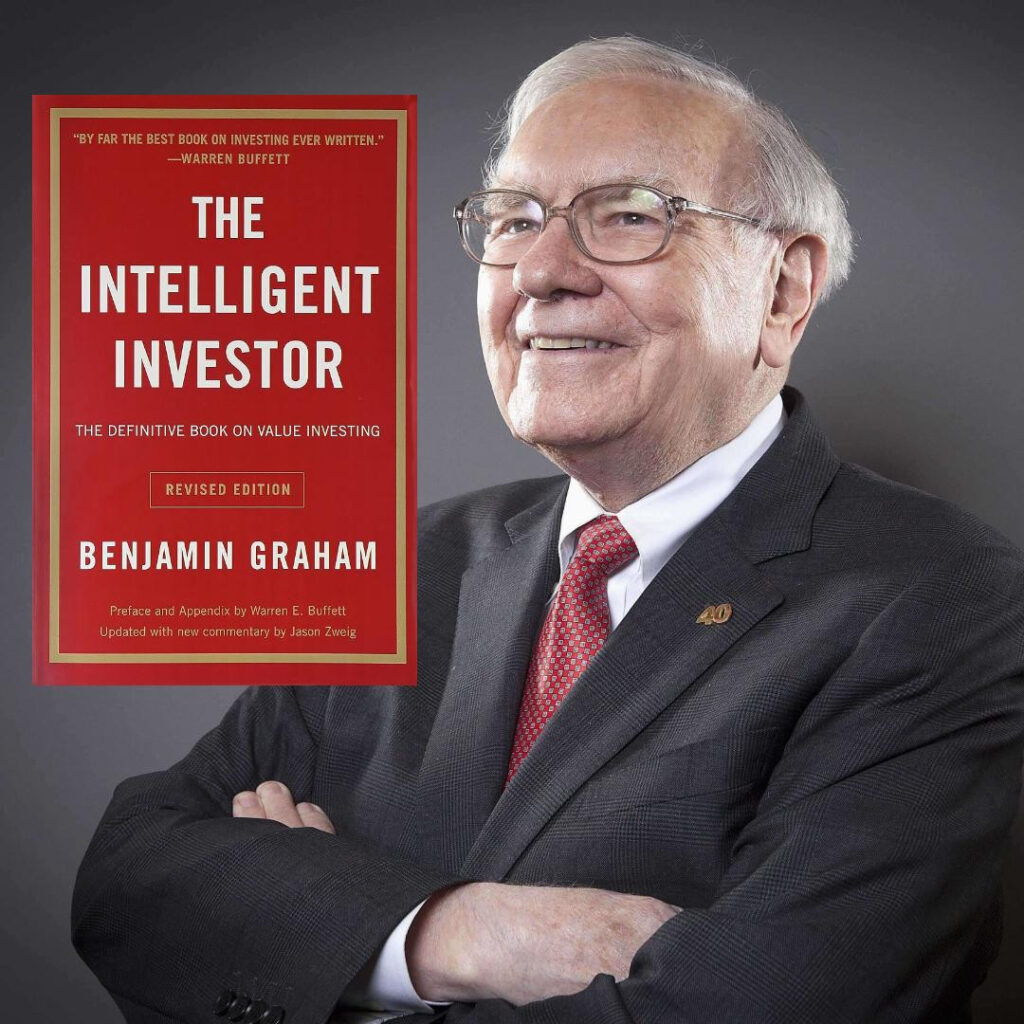

2. The Intelligent Investor by Benjamin Graham

Dubbed the “bible of investing,” this book emphasizes the principles of value investing. Benjamin Graham’s approach focuses on long-term strategies and minimizing risks, making it an essential guide for investors

Key Takeaways:

- Embrace the concept of “margin of safety

- Learn to analyze stocks and bonds effectively

- Understand the difference between investing and speculation

Why It’s a Must-Read:

Warren Buffett himself calls this book “the best book on investing ever written.” It’s a treasure trove of timeless advice for anyone serious about building wealth

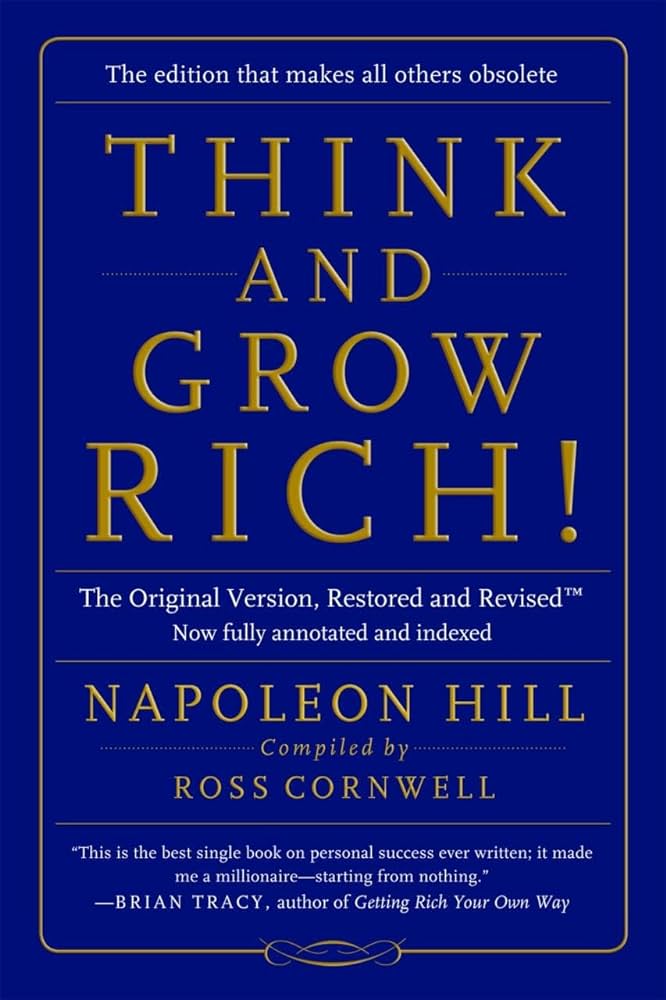

3. Think and Grow Rich by Napoleon Hill

This motivational masterpiece is not just about finance but about achieving success in all areas of life. Napoleon Hill shares 13 principles for attaining personal and financial goals based on studying successful individuals

Key Takeaways:

- Harness the power of desire and persistence

- Develop a “definiteness of purpose

- Use the power of your mind to attract wealth

Why It’s a Must-Read:

“Think and Grow Rich” combines mindset and strategy, making it a holistic guide to financial and personal success

4. Your Money or Your Life by Vicki Robin and Joe Dominguez

This book dives deep into the relationship between time, money, and happiness. It’s a step-by-step guide to achieving financial independence while aligning your spending with your values

Key Takeaways:

- Understand how to calculate your true hourly wage

- Track your expenses to gain financial clarity

- Achieve financial independence through conscious living

Why It’s a Must-Read:

If you’re looking to escape the paycheck-to-paycheck lifestyle and focus on what truly matters, this book offers actionable steps to transform your financial life

5. The Millionaire Next Door by Thomas J. Stanley and William D. Danko

Based on extensive research, this book shatters stereotypes about millionaires. It reveals how many wealthy individuals live modestly, prioritize saving, and build wealth over time

Key Takeaways:

- Learn the habits and traits of self-made millionaires

- Understand the importance of frugality and discipline

- Discover how to live below your means while growing your wealth

Why It’s a Must-Read:

“The Millionaire Next Door” offers a refreshing perspective on wealth-building, proving that financial success is within reach for anyone with the right mindset

Final Thoughts:

These books are more than just finance guides; they’re roadmaps to financial empowerment. By diving into their pages, you’ll gain valuable insights that can transform your relationship with money and set you on a path to financial success