As 2024 draws to a close, the fintech revolution in India is not just a trend; it’s becoming an essential part of how small businesses operate. With projections suggesting that the Indian fintech market could reach $1.5 trillion by 2025, entrepreneurs have a unique opportunity to harness technology for growth and innovation.

A Transformation in Payments

The Unified Payments Interface (UPI) has revolutionized India’s payment landscape, enabling instant money transfers through mobile devices. Launched in 2016 by the National Payments Corporation of India (NPCI), UPI allows users to link multiple bank accounts to a single mobile application, facilitating seamless transactions. In October 2024, UPI processed a record 16.58 billion transactions, reflecting a remarkable 45% year-on-year growth. This surge underscores UPI’s critical role in promoting cashless transactions and financial inclusion across the country.

Accessing Capital through Fintech

Access to capital remains a significant challenge for small enterprises, often hindered by traditional banks’ stringent lending criteria. Fintech platforms like Lending kart are transforming this scenario by offering quick and flexible lending options based on alternative data. This allows entrepreneurs to secure funding rapidly often within hours—enabling them to seize business opportunities without the lengthy delays typical of conventional banking methods.

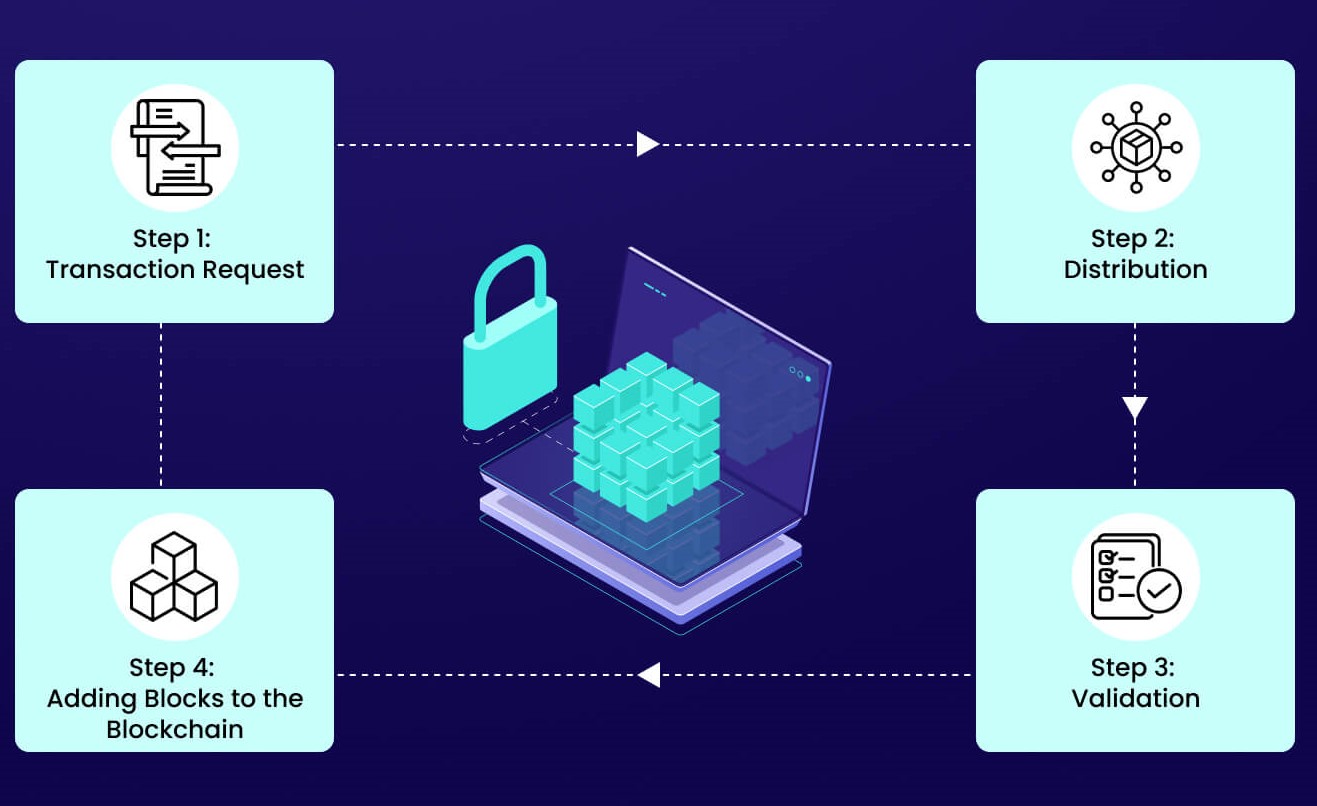

Blockchain: A Secure Future

Blockchain technology is making significant strides in the fintech sector, particularly in enhancing cross-border payments. By adopting blockchain solutions, businesses can execute transactions almost instantly and at a fraction of the cost compared to traditional methods. This technology offers improved security and efficiency, reducing the risks associated with fraud and delays in financial dealings. As more fintech applications integrate blockchain features, small businesses stand to benefit from these advancements, streamlining their operations and facilitating smoother international transactions.

The Promise of Financial Inclusion

Fintech is also playing a crucial role in promoting financial inclusion among underserved communities. By providing accessible financial services to those previously excluded from traditional banking such as rural women or informal workers small businesses can tap into new customer segments while contributing positively to society.

Embracing the Future

As we approach 2025, the rise of fintech offers tremendous opportunities for small businesses across India. By leveraging advancements in digital payments, alternative lending, and AI-driven insights, entrepreneurs can enhance their operations and strengthen customer relationships. Those who embrace these innovations will be well-positioned to thrive in a competitive landscape. The future is bright for those ready to harness the power of fintech—are you prepared to seize these opportunities?